The German Federal Government’s High-Tech Strategy

The goal of the High-Tech Strategy is to make Germany a pioneer in resolving the global challenges facing the fields of climate/energy, health/nutrition, mobility, security, and communication.

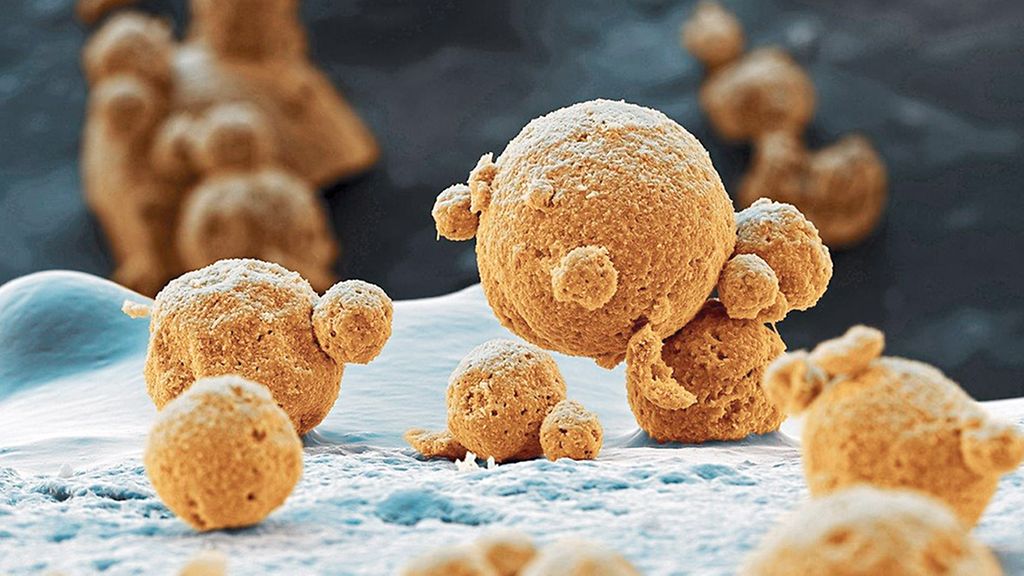

Action Plan Nanotechnology 2015

With the Nano Initiative, which was launched in 2006 as part of the High-Tech Strategy, the German federal government is promoting consistent exploitation of the potential for added value that nanotechnology offers, in an effort to strengthen Germany as a location for innovation and technology. The Action Plan Nanotechnology 2015, which was published in January 2011, is an interdepartmental, integrated concept regarding the responsible use of nanotechnology in Germany.

Joint Initiative for Research and Innovation

In June 2005, the heads of Germany’s federal and state governments passed the Joint Initiative for Research and Innovation and the Excellence Initiative for Cutting-Edge Research at Institutions of Higher Education, with the goal of strengthening Germany’s position as a location for science and research over the long term and further improving the country’s global competitiveness. These agreements include public sector approval for annual budget increases of a certain minimum percentage for the Max Planck Society (MPG), the Leibniz Association (WGL), the Helmholtz Association of German Research Centers (HGF), the Fraunhofer-Gesellschaft (FhG), and the German Research Foundation (DFG). While these budget increases amounted to at least 3 percent for the duration of the first Joint Initiative for Research and Innovation (until 2010), the heads of Germany’s federal and state governments decided on June 4, 2009 to renew the Joint Initiative with annual budget increases of at least 5 percent during the years from 2011 to 2015. The federal and state governments plan to work in concert with these research institutions in the context of the Joint Initiative in order to meet the following research objectives: