Estimated Energy Industry Turnover 2021(in EUR)

Your company is already operating in Germany and you would now like to export worldwide?

Key Facts

Germany's energy sector is a key player in Europe and the world. Major companies including E.ON, EnBW, and RWE dominate the domestic market. However, the sector has seen substantial growth and new market entrants – particularly in renewable energy with around 276,000 people employed in the sector in 2023. Government policy, economic incentives and strong public awareness have driven the shift towards sustainable electricity sources. Buildings and industry have now become the focus of attention with the decarbonization of heating and industrial processes through technologies including heat pumps, heat networks and hydrogen.

Industry Sectors

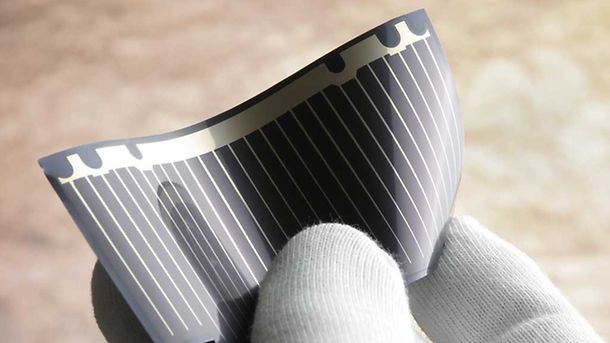

Germany leads in energy innovation, investing heavily in infrastructure and efficiency. With cutting-edge advancements in battery storage, hydrogen, solar, and wind energy, Germany is at the forefront of the global energy

News

Meet Us

Meet us at trade fairs and conferences worldwide or join our webinars. Schedule an appointment with our mobility experts. Find someone at the nearest global location to you or visit us in our Berlin headquarters. Our service is sponsored by the German government and therefore free of charge!

Downloads

Looking for detailed reports on industry segments and opportunities? Download our free Industry Overview for more data, analysis and insights.