turnover in 2023

Your company is already operating in Germany and you would now like to export worldwide?

Key Facts

Electronics Industry Facts & Figures

Innovation Powerhouse

Germany’s electronics sector is a vibrant hub for innovation and cutting-edge technologies. It accounts for 23 percent of the country’s total R&D spending – driving breakthroughs in microelectronics, automation, and digital solutions.

Global Market Presence

The industry serves as Europe’s leading production and sales market for electrical and electronic goods. With export share of around 50 percent, German electronics companies have a large international footprint.

Job Opportunities and Stability

The sector employs over 900,00 skilled professionals within Germany, offering diverse career path opportunities. Job security and continuous growth make it an attractive choice for both experienced professionals and newcomers.

Investment Potential

Despite challenges, the industry’s aggregated turnover reached EUR 239 billion in 2023, showcasing its resilience. Investors can tap into opportunities across the value chain from microelectronic components to smart devices and green technologies.

IoT Leadership

Germany’s focus on the Internet of Things (IoT) positions it as a leader in connected solutions. Internet of Things spending is projected to exceed EUR 35 billion, making it a lucrative market for investors.

Cutting-Edge R&D

Germany’s commitment to R&D is unparalleled. The industry invests a substantial 30% of all R&D spending in the country. Collaborations between industry players, research institutions, and start-ups drive continuous innovation. Research and development fuels breakthroughs in microelectronics, smart manufacturing and sustainable technologies – positioning Germany at the forefront of global advancements.

Opportunities

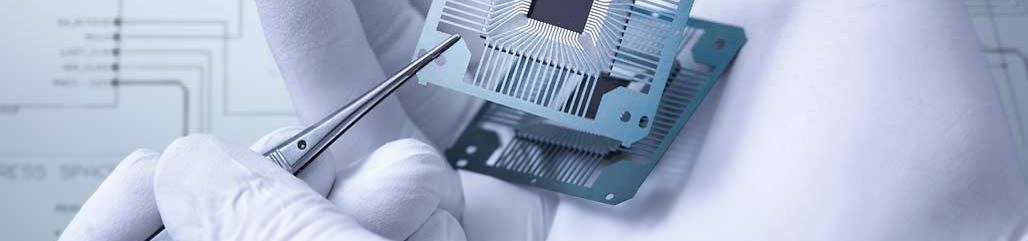

Semiconductor Industry

Germany is Europe’s leading player in the semiconductor landscape. With major investment to the tune of around EUR 50 billion at the production facilities of Intel, TSMC, Wolfspeed and Infineon, Germany is consolidating its position as a strong player in the global semiconductor ecosystem.

The Internet of Things (IoT)

The Internet of Things (IoT) is one of the most promising innovation accelerators for digital enterprises. Areas of application cover everything from manufacturing and construction to retail as well as transportation – in fact almost all sectors that utilize online devices or sensors. Internet of Things applications are of significant strategic importance for microelectronic manufacturers. Within Germany, the IoT market is expected to witness significant growth in the coming years. Forecasts predict an annual growth rate of around 10.6 percent from 2024 to 2028 – with total market value of around EUR 49 billion in 2028.

Automotive Industry

The German automotive industry is playing a pivotal role in the global transition to electric mobility solutions. Innovative systems in the field of battery management, power electronics, and charging infrastructure will be needed to drive future electric mobility demand.

Consumer Electronics

The consumer electronics market in Germany is set to generate EUR 25.9 billion in revenue by 2024 and is projected to grow annually at a rate of just over one percent until 2028. The largest segment within this market is telephony, with market volume of EUR 8.85 billion.

Business Environment

Framework Program for Research and Innovation

This program focuses on innovative electronic systems crucial for areas including autonomous vehicles, manufacturing machinery, medical technology, and telecommunications. The goal is to ensure that these systems continue to originate from Germany.

The Horizon Europe Strategic Plan

This plan outlines key strategic directions for the first four years of the European Union’s research and innovation framework program. It aims to restore industrial leadership, foster green and digital transformations, and allocate EUR 86 billion in funding for research and innovation initiatives.

Streamlined Planning and Approval Processes

The federal government advocates for accelerated procedures in planning and approval to promote investment. Examples include the construction of liquefied natural gas terminals and the expansion of renewable energies.

Renewable and Affordable Energy

The German government is heavily investing in the development of renewable energy sources. Almost half of the electricity in Germany already comes from renewables. By 2030, this share is expected to reach 80 percent.