Markets Germany Magazine 2/25 | Energy

Smart Measurements for Smart Grids

Germany is rapidly expanding its smart-grid infrastructure to support the transition to clean energy. This shift presents lucrative opportunities not only for manufacturers of smart-home technology and smart meters but also for energy service providers offering flexible rates.

Aug 21, 2025

Imagine having to pay to get rid of a product. Germany’s commitment to renewable energy is reshaping its electricity market, but if supply exceeds demand, power producers receive no revenue for their electricity. In fact, they’re charged to feed it into the grid. In 2024, electricity prices on the German energy exchange turned negative for a record-breaking 457 hours.

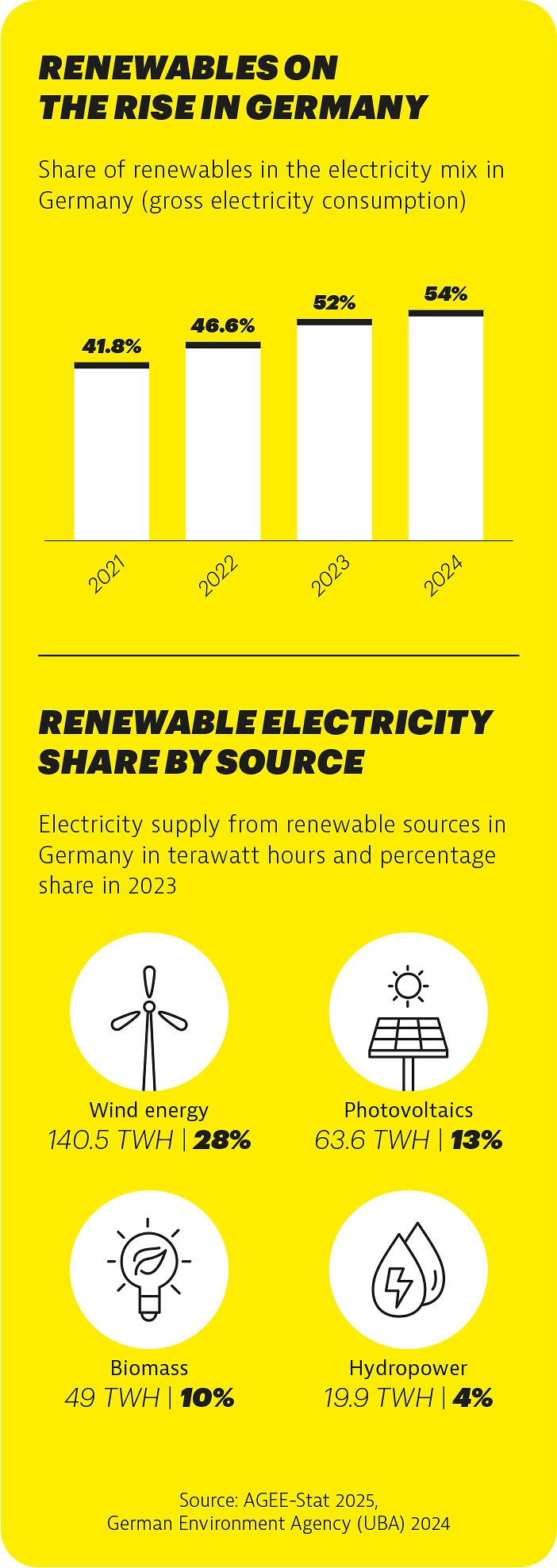

The underlying reason is that wind and solar power — upon which Germany is increasingly reliant — depend on the weather. Thus, unlike gas- and coal-fired power, they cannot be rigidly planned. As a result, there are times when renewable energy generation exceeds demand, and with limited storage capacity, the surplus cannot easily be absorbed.

With load fluctuation set to rise with increasing use of renewables, Germany needs a smarter power grid, and fast. Rather than controlling electricity generation, the future grid will manage absorption capacity through battery storage, as well as consumption.

This article was published in issue 2-2025 of the Markets Germany Magazine. Read more articles of this issue here

Meters make the difference

At the heart of this transformation are intelligent measurement and hardware. “They’re the key to the smart grid,” says Heiko Staubitz, energy market expert at Germany Trade & Invest (GTAI). Smart meters (SMGWs) equipped with communication units — known as gateways — can transmit and receive signals, enabling remote-control functions.

Recognizing their crucial role, Germany is expediting the rollout of SMGWs. Beginning in 2025, installation will become mandatory for three key groups: consumers using 6000 kilowatt-hours (kWh) or more annually, operators of energy generation systems with a capacity of at least 7 kW, and users of large, controllable electrical devices such as heat pumps and electric vehicle (EV) charging stations.

This expansion makes Germany an increasingly attractive location not just to smart meter manufacturers and installers, but to renewable energy management service providers as well. “Compared to other European countries, Germany has a higher share of privately owned photovoltaic systems, and many EV owners charge their vehicles at home rather than in public charging stations,” notes Patrick Vollmuth, head of digital innovation and flexibility integration at the Munich Research Center for Energy Economics.

Innovative companies offering solutions to efficiently manage energy consumption across these devices — including heat pumps, solar panels, and EV chargers — will find a receptive market in Germany.

The Bottom Line

Germany’s smart meter rollout is creating business opportunities not only for hardware manufacturers but also for innovative energy management service providers.

Leveraging volatility

The market is further bolstered by German households’ and small businesses’ interest in leveraging electricity price fluctuations. More and more consumers, even those using less than 6000 kWh annually, are opting to install smart meters to take advantage of dynamic electricity rates and reduce costs. “Dynamic rates are becoming increasingly popular, and smart meters are necessary to get them,” Vollmuth explains.

Pioneers such as UK-based Octopus Energy recognize the potential of this trend in Germany. Since entering the German market in 2020, the British company has offered rates that track short-term electricity price fluctuations on the exchange. The business model relies on a proprietary cloud-based technology platform.

Major international players, such as French technology giant Schneider Electric, are also seizing opportunities in the market. In late 2024, Schneider announced a 10-million-euro expansion of its German facility in the western German town of Wiehl, near Cologne, focusing on smart home device production.

Schneider Electric’s venture capital arm, SE Ventures, also invested in Berlin-based start-up Ostrom. Founded in 2021, Ostrom is working to decentralize and increase the flexibility of electricity generation in Germany, while offering dynamic rates and EV charging solutions.

These developments underscore the momentum of Germany’s smart meter rollout. “It’s not just about device manufacturers. Creative, data-driven and AI-powered business models now have a real opportunity to shape this young and rapidly growing market,” says Heiko Staubitz.

The rising number of heat pumps, EV chargers, solar panels and battery storage systems in German households will further drive demand for smart energy management services. Beyond smart meters, one crucial element will be software that can efficiently and reliably coordinate variables across a decentralized, intelligent power grid in an industrialized nation of over 80 million people.

Numbers

3.4 m

Number of photovoltaic

systems installed on roofs

in Germany in 2024

Source: Federal Statistical Office

of Germany

457

Number of hours in 2024 when Germany’s electricity exchange price fell below €0/MWh

Source: Federal Network Agency

41

Number of hours in 2024 when Germany’s electricity exchange price exceeded €300/MWh

Source: Federal Network Agency