Markets Germany Magazine 2/25 | Healthcare

The Next Biotech Breakthrough?

Investment in biotechnology is surging globally and Germany — the fourth largest pharma market in the world — excels in the field. Every year it attracts more international investors and companies to fund the development of new medicines and vaccines.

Jun 05, 2025

The Covid-19 pandemic was a historic moment for German biotech. In 2020 a small team of researchers from Mainz, led by a immunologists Uğur Şahin and Özlem Türeci, gained international fame in 2020 when they developed the first mRNA vaccine for coronavirus and partnered with the US pharma giant Pfizer to bring it to market.

For decades, the medical research establishment overlooked therapies based on messenger RNA because it was considered “too unstable”. BioNTech changed all that. Today it is a multinational company worth billions and continues to advance mRNA technology, focusing on developing new vaccines and its core business: cancer therapies. Currently, ten cancer immunotherapies are in various stages of clinical trials, with one expected to receive market approval as early as 2026.

The Bottom Line

The Covid-19 pandemic threw a spotlight on German biotech, a sector that has been attracting international investment steadily ever since. Today the cutting edge of research and development is in finding cures for cancer.

Medical breakthroughs like these are fueled by a steadily growing stream of investment. Last year, biotech investment in Germany reached an all-time high (excluding the pandemic-related surge): Approximately EUR 2 billion in fresh capital flowed into the industry — a 70 percent annual increase. “Biotechnology is a key industry for Germany and plays a significant role in value creation across multiple sectors, particularly in industrial healthcare and the bioeconomy,” says Viola Bronsema, MD of BIO Deutschland. The industry’s momentum is also reflected in the market: Since 2022, pharma sales in Germany have been rising steadily, increasing by almost 8 percent from 2023 to 2024 to reach more than EUR 55 billion.

Aside from a huge market, Germany offers strategic advantages. “The ecosystem, ranging from academia, research institutes and highly qualified scientists to equipment suppliers and industrial partners is extraordinarily strong,” explains Marcus Schmidt, Director Chemicals & Healthcare at Germany Trade & Invest. “A key advantage for pharmaceutical companies is also the very short time from regulatory approval in the EU to availability on the German market. Other countries take ten times as long.”

Dynamic biotech clusters

With robust legal frameworks such as patent protection, Germany provides foreign investors and companies an exceptional business environment for launch and scaling. The country is also home to several high-performing biotech clusters, where research institutions, companies and investors collaborate on developing the next big medical breakthroughs. One of the most prominent hubs, BioRN, is located in the Rhine-Neckar region in southwest Germany. Its mission is to attract international investment and top-tier talent. More than 140 SMEs, research institutions and ten global pharmaceutical companies are members of BioRN.

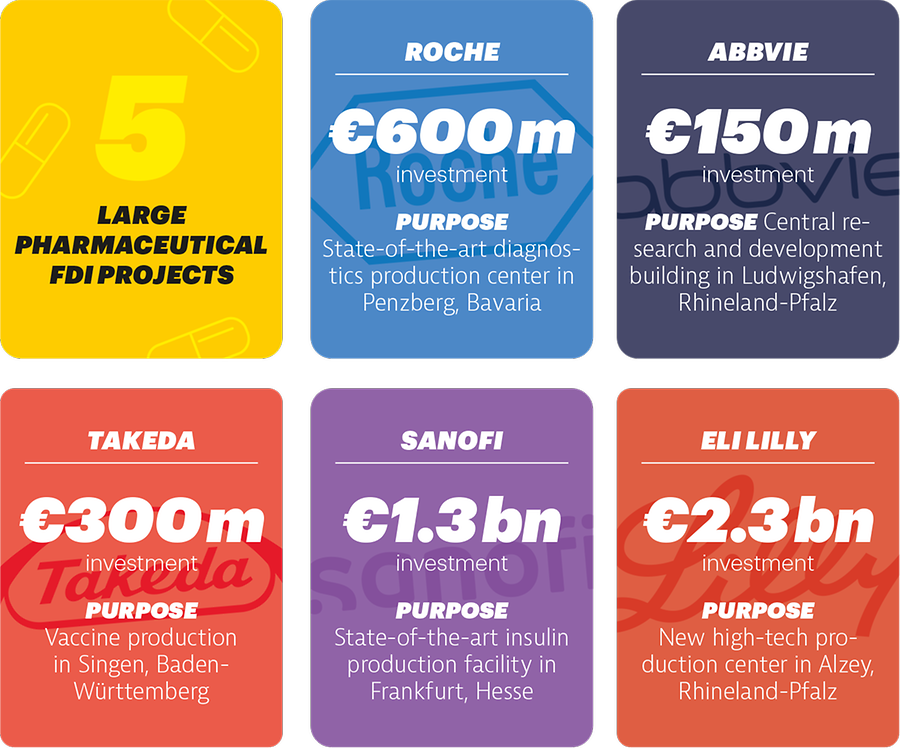

One of them is US biotech giant AbbVie, which has its German headquarters in Wiesbaden. Since 2020, AbbVie has invested over EUR 400 million in expanding its second-¬largest research and development site worldwide, located in Ludwigshafen. Last year, EUR 150 million were allocated for the construction of a new research facility. “With this investment, we are reinforcing the strategic importance of our Rhineland-Palatinate site within AbbVie’s global network,” says Thomas Merdan, General Manager Research and Development at AbbVie Germany. Around a third of the site’s a thousand or so researchers will work in a cutting-¬edge six-¬story research and laboratory facility. “We firmly believe that Germany — and specifically the regional state of Rhineland-Pfalz — offers outstanding conditions for the pharmaceutical and biotech sectors. It is crucial that policymakers and industry leaders continue to foster this development.” The region also attracted US-pharmaceutical company Eli Lilly, which broke ground for a EUR 2.3 billion production facility in 2024.

This article was published in issue 2-2025 of the Markets Germany Magazine. Read more articles of this issue here

Record-breaking investments

The Munich metropolitan area is also among Europe’s leading biotech hubs. More than 450 life sciences companies, universities and renowned research institutes, including three Max Planck Institutes, are based in the region. Last year, three Munich-based biotech companies secured record-breaking funding from international investors. Tubulis raised EUR 128 million to develop targeted chemotherapies that act solely on cancer cells. Catalym secured EUR 137 million for its novel compound that prevents cancer cells from developing resistance to anti-cancer drugs. ITM, a radiopharmaceutical specialist, received EUR 188 million to further its research into targeted cancer therapies using radioactive isotopes. A year earlier, ITM had set an industry record with EUR 255 million in venture capital financing.

International corporations are also making significant investments in the greater Munich area. Japanese pharmaceutical company ¬Daiichi Sankyo, for instance, has committed around EUR one billion for the expansion of development and production capacities by 2030. “With this investment, we aim to further develop our facility in Pfaffenhofen into a pioneering center for drug development and production,” says Nora Urbanetz, Head of ¬Daiichi Sankyo’s Europe Technology Unit.

The surge in investments in bleeding-edge cancer therapies reflects the fact that biotech is ones of Germany’s most rewarding economic sectors right now.

10 Reasons to Invest

Marcus Schmidt, Director Chemicals & Healthcare at GTAI, spells out the top ten advantages of Germany as a biotechnology location:

- Germany is excellent in basic research with a number of world-renowned research institutions such as the German Cancer Research Center in Heidelberg and the Max Delbrück Center for Molecular Medicine in Berlin.

- More than 30 university hospitals, including the Charité, the largest in Europe, are actively involved in research and development, making Germany a world leader in clinical studies.

- Germany attracts lots of students, and well-educated scientists come from all over the world to study and work. This promotes the exchange of knowledge and cooperation on a global level.

- More than 30 technology clusters provide strong ecosystems for biotechnology companies, including start-ups.

- Germany is home to more than 800 dedicated biotechnology companies. While only few such as BioNTech are known to the general public, many German biotechs work very successfully with international partners.

- With more than 700 companies, Germany has the largest pharmaceutical industry within Europe. Many international companies have set up local operations for research, product development and production as well.

- Germany is also the largest market for pharmaceuticals in Europe with more medicines being reimbursed than in any other EU country, and the shortest time between approval and market availability for patients.

- Germany has an extensive network of suppliers and service providers for biotechnology and pharmaceutical companies, ranging from machinery and equipment to laboratory supplies and materials.

- Germany has a dedicated regulatory body for biopharmaceuticals and vaccines that is respected worldwide for its expertise. The Paul Ehrlich Institute (PEI) is also the leading institution for cell and gene therapy in Europe.

- The German federal government strongly supports the industry by creating reliable conditions, making more data available for research and improving efficiencies for clinical studies, as stipulated in the national pharmaceutical strategy 2023.