Markets Germany Magazine 3/25 | Technology

Agents of Fortune

Germany is emerging as a strategic hub for “agentic AI” — autonomous AI-driven systems that are revolutionizing industrial operations around the globe. That’s down to emerging innovation clusters, fast-evolving industry standards and a plethora of new commercial opportunities.

Oct 17, 2025

At Otto, Germany’s second-largest mail-order company, AI agents have taken over warehouse planning. Long before a human manager might notice stock levels running low, the smart system has already anticipated a potential shortage and placed a reorder. The agents learn from historical data but also factor in variables like weather and macroeconomic trends.

Otto is a great example of a wider transformation among industrial and commercial enterprises in Germany, which are integrating autonomous AI agents at remarkable speed.

With a strong SME base, a high degree of process automation and robust tech infrastructure, the country is at the forefront of the practical deployment of agentic AI across its industrial sectors. That’s good news for international AI solution providers.

“In Germany, real-world applications are materializing at record speed — in manufacturing, logistics, energy and inventory management,” says Asha-Maria Sharma, digital economy expert at Germany Trade & Invest (GTAI).

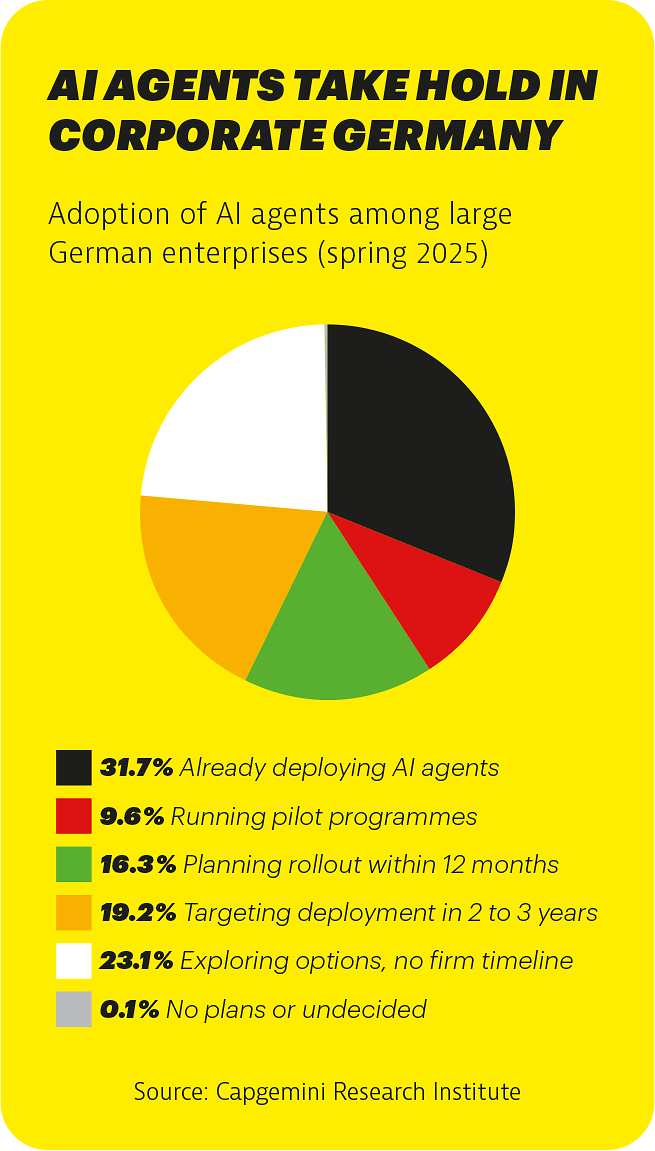

A recent survey highlights that momentum: 66 percent of German IT managers report already using AI agents, with another 27 percent planning to adopt them within the next year. For global AI providers, the market indications are clear: Germany is open to innovation and actively seeking bespoke solutions.

FDI Perspective: Your Trusty AI Financial Advisor

The fintech start-up PaceUP Invest has developed AI agents to provide personalized, digital financial advice. Here’s why it is committed to running operations from Germany.

In 2020, founder Rukayyat Kolawole launched PaceUP Invest with the goal of helping women and underrepresented groups build financial resilience through behaviorally informed, data-driven guidance powered by autonomous AI agents. She brought with her a wealth of financial expertise from roles at Goldman Sachs, Bloomberg and BMCE Bank International in London and New York. “We deliver AI-powered, behaviorally informed financial literacy and wealth-building tools,” says Kolawole. “Our agents analyze user data and simulate personalized investment strategies.”

The digital advisor is designed to be transparent, easy to understand and accessible around the clock. For Kolawole, Germany provides the ideal foundation: “The German economy is stable, and the local expertise is exceptional.” She also sees the country’s regulatory rigor as a particular advantage. “If you can get a financial license in Germany, you can expand anywhere,” she says. With offices in the UK and Nigeria and a growing international user base, PaceUP Invest is positioning itself as a global platform for digital financial advice — with Germany as both its launchpad and quality assurance base.

countries with locations : 3

employees: 6

B2C users: 20,000

Untapped potential

Despite Germany’s advanced automation landscape, the country is currently engaged in some catching up. Only one in four German companies believes it has fully leveraged the potential of AI, according to the industry association Bitkom. For AI merchants looking to enter new markets and forge strategic alliances, this means plenty of room to grow.

Bitkom data shows that German companies see the greatest potential for AI agents in core industrial domains: 85 percent cite energy management, 74 percent robotics, 73 percent analytics and 72 percent warehouse management. Providers with specialized agent solutions in these areas are well-positioned to gain traction in Europe’s biggest market.

“Anyone offering AI solutions that boost productivity or automate processes will find a ready market in Germany,” confirms Bitkom AI expert Marvin Pawelczyk.

Number of UK FDI projects in Germany (2024)

Source: Germany Trade & Invest,

Regional Business Agencies

Share of total UK investment projects (new) in smart manufacturing that go to Germany (2024)

Source: GTAI FDI Competence Center

Global tech moving in

Key international players have been quick to recognize Germany’s strategic importance in this evolving area. In May 2025, OpenAI opened a new office in Munich — a clear signal of commitment to the European market. With close proximity to the Technical University of Munich and strong industrial ties, the region offers an ideal springboard for global AI leaders.

“Germany is one of the most dynamic digital and industrial markets in Europe,” says Sandro Gianella, head of OpenAI’s Munich office. “Our local presence lays the foundation for global collaboration with businesses, academia and industry.” In addition to Munich, other locations such as Berlin, Frankfurt, North Rhine-

Westphalia and Heilbronn — home to the emerging Innovation Park Artificial Intelligence (IPAI) see p. 11 — are also gaining visibility.

In July, Texas-based Oracle announced a EUR 1.7 billion investment in its Oracle AI Agents services in the greater Frankfurt area. “The growing demand for cloud solutions shows that the digital transformation in our country is progressing well,” says the German Minister for Digital Transformation and Government Modernization, Karsten Wildberger, on the company’s website. “We welcome increasing investment, both from Germany and internationally, and welcome this investment expressly.”

The Bottom Line

Agentic AI is set to transform Europe’s economy, from industry to professional services. Germany is positioning itself at the forefront of this quiet but rapid revolution.

The advantage of regulatory clarity

For international companies, market potential must be balanced with regulatory considerations. The European AI Act has been met with some skepticism — but the concern is somewhat misplaced. While the legislation introduces obligations such as transparency in decision-making and safeguards against manipulative systems, it also creates predictability and trust — an increasingly compelling argument for corporate leadership abroad. “Providers that align with EU standards will be well-positioned to scale globally,” notes GTAI’s Sharma. Europe’s leadership in AI governance, she adds, may offer a gateway to regulated markets worldwide.

Issues of infrastructure and data sovereignty are also gaining importance. Germany offers alternatives to US-based cloud solutions, with European server locations, GDPR compliance and secure data space becoming decisive factors for many industry partners. International vendors with European-centric architectures have a significant strategic edge.

“There’s huge demand for AI solutions that are independent of US hyperscalers,” Sharma explains, citing not only compliance, but also trust, autonomy and industrial access.

This article was published in issue 3-2025 of the Markets Germany Magazine. Read more articles of this issue here

Solutions for every niche

While the development of foundational AI models is still dominated by the United States and China, Germany is carving out its own niche for specialized, high-implementation AI solutions. For decision-makers in international IT firms — especially those serving the mechanical engineering, automotive, or energy sectors — this presents a unique opportunity.

“Germany excels at finding the best solution for every niche,” says Daniel Abbou, the head of the German AI Association. Many German start-ups are developing promising agent-based AI solutions, particularly for industrial use cases and business services. Berlin-based Parloa, for example, which builds AI agents for customer support hotlines, is now one of Germany’s most valuable tech start-ups.

While many of these firms are strong on innovation, they often lack the resources for international expansion. This creates fertile ground for strategic partnerships. Global AI providers seeking a foothold in Germany could benefit from collaborations in product development, local implementation or go-to-market strategies. And the best way to do that is to put an AI agent on the ground by expanding to Europe’s top market.