Markets Germany Magazine 3/25 | Manufacturing

Jolly Good Business

Germany is a top destination for British businesses, especially innovative manufacturers. Robert Scheid from the London office of Germany Trade & Invest (GTAI) and manufacturing expert Peggy Görlitz share their insights into why the UK’s industrial sector is increasingly looking to Germany to expand its European footprint.

Dec 09, 2025

Mr. Scheid, British companies’ interest in Germany seems to be growing. What’s behind this trend?

Robert Scheid: Since 2018, UK investment patterns have shifted significantly due to Brexit. In the early stages, uncertainty held many companies back. But the 2019 Withdrawal Agreement between the UK and the EU brought more legal clarity, prompting a wave of British firms to establish operations in Germany. The main driver has been the need to maintain access to the EU market.

Many of these firms are high-end manufacturers, and Germany remains Europe’s industrial heartland. Back in 2019, some companies started by setting up warehouses, but now we’re seeing long-term commitments — production facilities rather than just logistics hubs. Post-Brexit trade rules have complicated UK-to-EU exports, especially for businesses with complex supply chains. Establishing a legal entity in Germany helps them avoid tariffs and logistical challenges.

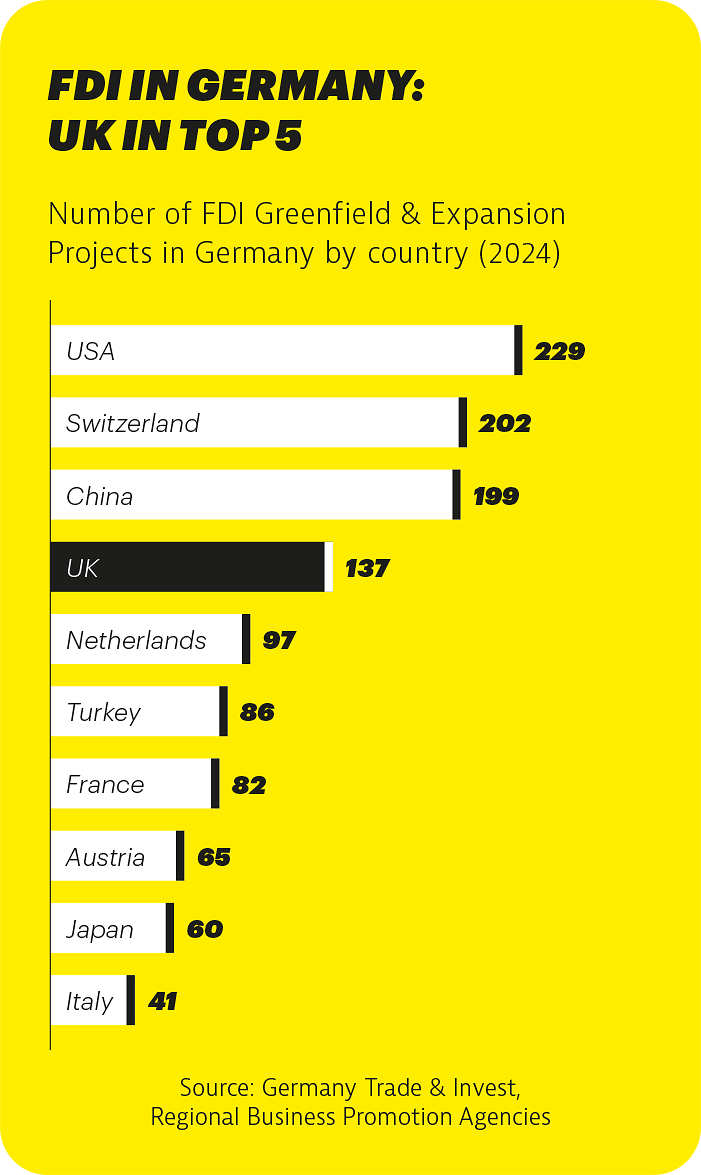

Today, the UK ranks as Germany’s fourth most important source of inward investment — somewhat akin to a “new Switzerland,” closely connected, yet outside the EU framework.

Ms. Görlitz, is it true to say that British tech companies in manufacturing are particularly drawn to Germany?

Peggy Görlitz: Absolutely. We’re seeing considerable interest from UK firms in electronics and automation. Germany’s economic resilience and its strong industrial backbone are key attractions. And British companies here find themselves in close proximity to a large customer base.

Are there other reasons why British manufacturers are choosing Germany over other EU countries?

PG: Germany offers excellent conditions for production-oriented and tech-driven firms. There’s a dense ecosystem of innovators, industrial players and research institutions. Take additive manufacturing — it’s booming. British companies in this space see Germany as the ideal launchpad for developing and scaling advanced technologies.

Which German regions are attracting the most investment from British manufacturing companies?

PG: When we look at additive manufacturing, Bavaria stands out, especially Munich with its renowned Technical University. North Rhine-Westphalia is another key hub, while Berlin draws start-ups and Hamburg excels in aviation. These regions combine established corporations, agile start-ups, research bodies and universities — creating a rich talent pool and collaborative environment.

This article was published in issue 3-2025 of the Markets Germany Magazine. Read more articles of this issue here

How does GTAI support British firms entering the German market?

RS: My job is to work closely with UK companies and help them navigate Germany’s decentralized market landscape. GTAI offers support on everything from legal and tax matters to government funding opportunities at federal and state levels. We also connect them with the right regional partners. Our goal is to make the market entry process as seamless as possible.

What are the main challenges UK firms face when setting up in Germany?

RS: Germany’s decentralized structure can be a hurdle, and bureaucracy is another. In the UK, you can register a business online in just a couple of hours. In Germany, the process is more paperwork-driven and time-consuming. That said, the government has pledged to streamline business registration to within 24 hours, which is a promising development. Language can be another challenge. While much business is conducted in English, dealings with local authorities often require some German proficiency.

What’s the feedback you get from UK businesses coming to Germany?

RS: Many British firms are pleasantly surprised by Germany’s strong, trust-based business culture. While it may take longer to build relationships than in the UK, once that trust is established, German partners are known for their loyalty and reliability. This often translates into long-term business success.

PG: I agree. Entering the market can be complex, but the potential rewards are significant. Germany offers a stable, innovation-friendly environment in which companies can truly thrive.

British start-up Fyous has eyes on Germany

Thomas Bloomfield, co-founder and COO of Fyous, explains why the British manufacturing-tech start-up sees Germany as the next frontier in its expansion strategy.

Mr. Bloomfield, can you give us a brief overview of what Fyous does and what makes your technology unique?

Fyous has developed a process called “polymorphic molding.” It uses more than 28,000 digitally controlled pins to create a mold directly from a digital 3D model in under an hour. The technology has wide applications, from packaging solutions to custom medical devices and aerospace components.

Is the system reusable?

Yes. The same mold can be reconfigured for different products, making it significantly more efficient than traditional molding or 3D printing. This approach speeds up production, reduces waste and is compatible with various manufacturing methods, including vacuum forming and foam casting.

You’re looking to expand to Germany. Where do things currently stand?

Right now, we’re raising capital in the UK to support our growth plans. We haven’t yet chosen a specific location in Germany. Our priority is to gain deeper market insight.

Last year, we exhibited at the Formnext trade fair in Frankfurt, which helped us build connections and introduce our technology to potential partners. We also attended a more targeted industry event in Germany this September.

Our goal is to have equipment up and running in Germany by the end of the year and begin establishing a local footprint.

What makes Germany an attractive destination for Fyous?

Germany’s engineering heritage, advanced manufacturing ecosystem and status within the EU post-Brexit all make it highly appealing. We’ve identified potential customers across several sectors. For example, Germany has a large number of orthopedic footwear manufacturers — from major players to artisanal producers. Many rely on custom shoe casts, which our technology can efficiently provide. Producing locally means these customers wouldn’t need to import our equipment.

What challenges do you foresee as Fyous enters the German market? Where will you have to work the hardest?

Many of our potential customers are quite traditional and may be cautious about adopting new technology. At the same time, they face growing pressure to modernize and improve efficiency. Our challenge is to clearly demonstrate to new customers in Europe how our solution drives innovation, reduces waste and accelerates production. We’re confident that as the benefits become evident, interest will follow.

Number of UK FDI projects in Germany (2024)

Source: Germany Trade & Invest,

Regional Business Agencies

Share of total UK investment projects (new) in smart manufacturing that go to Germany (2024)

Source: GTAI FDI Competence Center